It’s not an exaggeration to say that XRP has been one of the most talked-about cryptocurrencies of the past few years. From legal battles to dramatic price swings, the token behind Ripple Labs continues to hold a strange magnetism in the crypto world. Investors, traders, and even skeptics find themselves checking the XRP price USD almost daily—hoping to read the next big move hidden between candlesticks.

But staying ahead of XRP’s market means more than glancing at charts. You’ve got to understand the forces at play: the regulations, the rumors, the whales, and of course, the data itself. Let’s break it down, human-style—typos, fragments, and all.

The Current Snapshot: XRP Price USD Live

As of this week, XRP trades roughly around $0.59 USD, though it’s been bouncing between $0.55 and $0.63 for several days. The market cap sits near $32 billion, keeping it comfortably among the top ten cryptos by value. Not bad for a token that’s been fighting legal headwinds since 2020.

If you look at real-time data from exchanges like Binance, Coinbase, or Kraken, XRP’s movement is choppy—up a little, down a little, always teasing the next direction. The live XRP price USD charts show short bursts of volume, followed by quiet consolidation. In other words, traders are waiting for something.

That “something” could be another ruling in Ripple’s legal case against the U.S. Securities and Exchange Commission (SEC), or maybe just the next big Bitcoin rally. Either way, XRP tends to mirror the wider crypto mood—but with its own quirks.

Ripple’s Legal Drama Still Matters

It’s impossible to talk about XRP without mentioning the SEC. Back in late 2020, the SEC accused Ripple Labs of selling unregistered securities—essentially calling XRP a security rather than a currency. The case dragged on for years, sending XRP’s price tumbling and scaring off many U.S. exchanges.

Then in 2023, Ripple scored a partial win. A judge ruled that XRP itself wasn’t necessarily a security when sold to the public. The market reacted instantly—XRP spiked nearly 80% within hours, pushing the XRP price USD past $0.85 for a short while.

But the story didn’t end there. The SEC appealed parts of the decision, and the uncertainty returned. Since then, XRP’s value has cooled, but it remains stable compared to earlier lows. Traders are keeping one eye on the court docket, another on the charts. Legal clarity could push XRP to $1 again—or beyond—if Ripple fully wins.

Technical Analysis: What the Charts Are Saying

If you’re a chart watcher, XRP’s pattern over the last year has been… frustrating but interesting.

The price formed a long base around $0.45 earlier this year before breaking above $0.55 in October. That’s a bullish sign, technically speaking, showing accumulation by stronger hands. But XRP keeps running into resistance near $0.65–$0.70, where sellers show up.

On daily charts, the Relative Strength Index (RSI) sits around neutral—neither overbought nor oversold. Moving averages, particularly the 50-day and 200-day, are inching closer to a crossover point. If the 50-day moves above the 200-day, that’s what traders call a “golden cross”—a possible bullish indicator.

Still, crypto doesn’t follow perfect textbook patterns. One whale transaction, one legal headline, and all those pretty lines can go out the window.

Market Factors Influencing XRP Price USD

A few key elements are driving XRP’s current valuation:

- Institutional AdoptionRipple’s technology continues to power cross-border payments for banks and financial institutions. While that doesn’t always move the XRP token directly, it builds credibility. Some analysts believe future partnerships with global payment providers could strengthen XRP’s value in the long run.

- General Crypto SentimentWhen Bitcoin sneezes, altcoins catch a cold. A weak BTC often drags everything down, XRP included. But when Bitcoin rallies, XRP tends to follow—sometimes outperforming due to speculation around Ripple’s legal situation.

- Whale MovementsOn-chain data shows large wallets quietly accumulating XRP since mid-2024. That’s often seen as a bullish sign, though it’s not foolproof. Sometimes whales simply move tokens between exchanges. Still, it adds intrigue.

- Global RegulationsOutside the U.S., countries like Japan, Singapore, and the UAE have been more friendly toward Ripple’s technology. If more governments adopt RippleNet for payments, XRP’s use case could solidify, lifting its price naturally.

Expert Opinions & Price Predictions

Predictions in crypto are dangerous territory—but fun to read. Analysts and traders are divided.

- Optimists see XRP hitting $1.20–$1.50 by early 2026, assuming Ripple wins its remaining legal hurdles and the crypto market continues its recovery.

- Skeptics argue XRP might struggle to break $0.80 without a massive catalyst. They say the token’s lack of supply burn and limited retail hype keep it capped.

- Neutral analysts believe XRP will continue consolidating between $0.50–$0.70 until the market picks a direction.

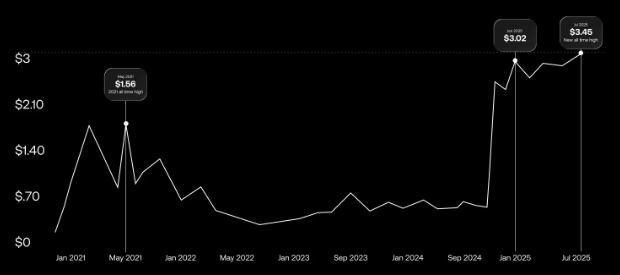

A few even whisper about XRP reclaiming its 2018 all-time high of $3.84 USD, though that feels distant right now.

Still, the live charts tell one thing: XRP isn’t dead. It’s alive, pulsing, waiting for a reason to move.

How to Stay Ahead

The best way to keep track of XRP’s next big shift? Constantly monitor live charts and market analysis tools. Follow sites like CoinMarketCap, TradingView, or Bitget for real-time updates on xrp price usd movements.

Beyond price, keep an eye on:

- Ripple’s official news releases and legal updates

- Major exchange listings or delistings

- On-chain whale activity (via platforms like Whale Alert)

- Global banking partnerships Ripple announces

Crypto rewards those who stay informed, not those who react late.

The Bottom Line

At the end of the day, XRP is a mix of potential and uncertainty. The XRP price USD might look calm on the surface, but underneath, it’s a tug of war between fear, hope, and speculation.

The token has survived lawsuits, delistings, and market crashes—yet here it stands. Whether XRP climbs to new heights or drifts sideways will depend on forces far bigger than charts alone. But one thing’s clear: if you’re watching the live data, staying alert, and understanding the bigger story, you’re already one step ahead.

Because in crypto, staying ahead isn’t about luck. It’s about paying attention—every hour, every swing, every candle.